Procurement in M&A Projects

M&A projects are under time pressure. Some stakeholdes migh start to relax after signing. but ...

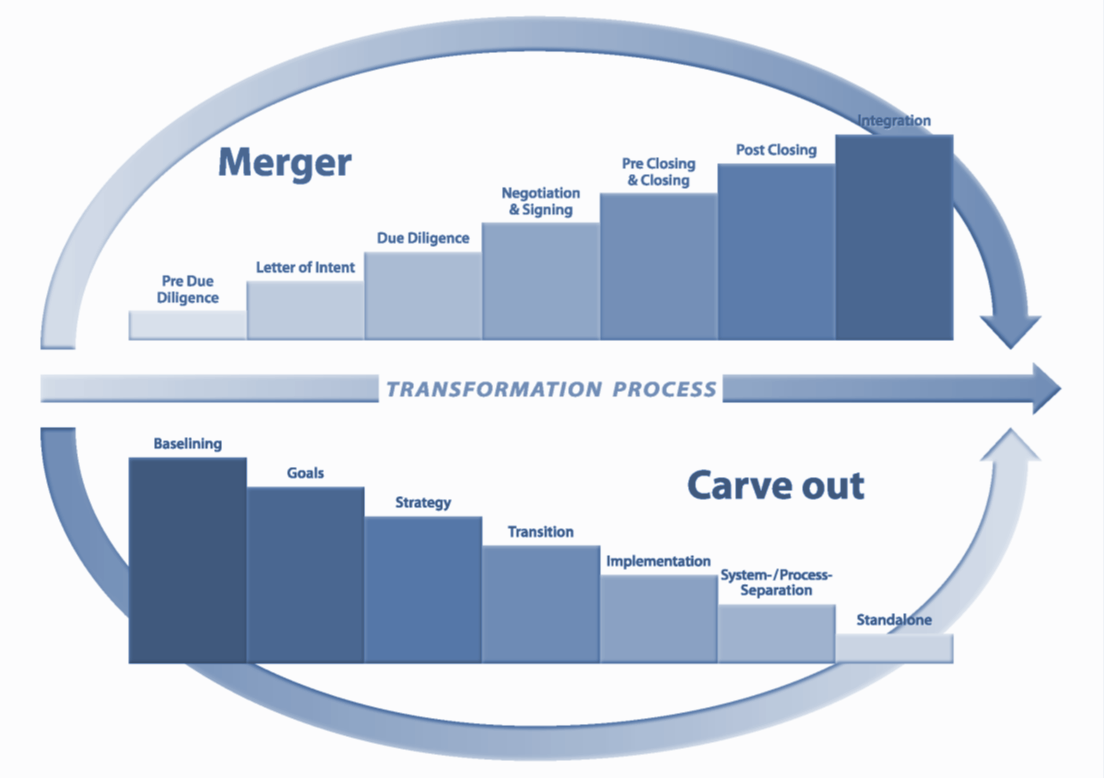

The implementation phases place a significant burden on the operational units and tend to push them over the limits of their capacity or expertise. This can imply high costs threatening the success of your project.

We provide for planning and execution of the operational aspects of your M&A projects from the procurement perspective.

![]()

Contractual Baselining and the Separation of contracts is one of the major time consuming tasks in a Carve-Out project. These contractual relationships, reaching from frame contracts to active orders might have to be re-negotiated with suppliers. This could easily be an effort for several hundred contracts.

Risc Assessments have to be conducted in the Due Diligence and the negotiation phases for costs which result from existing supplier relations and commitments, for both sides. These data have to be elaborated rapidly in a very short time.

Business Processes (IT, Payroll, Accounting, Taxes, Travel, Fleet, ...) which might not be availble anymore after the Change-of-Control need to be re-installed for a stand-alone scenario. Integration projects likewise.

The early common development of synergies in procurement even already in the post-signature phase places special requirements in the execution and communication (e.g. via a data room)

Your Benefit:

We offer our support the Pre-Signature as well as in the Post-Signature phases from Due Diligence to Data Room and create synergies in Procurement.

Project timeline: We provide resources for Carve-Out and Integration to alleviate the potential overload of operational units.

Reduction of the use of costly 'Transitional Service Agreements'.

Optimized procurement through applied material expertise. Throughout the Indirect Material we do have a long real life history of expertise.